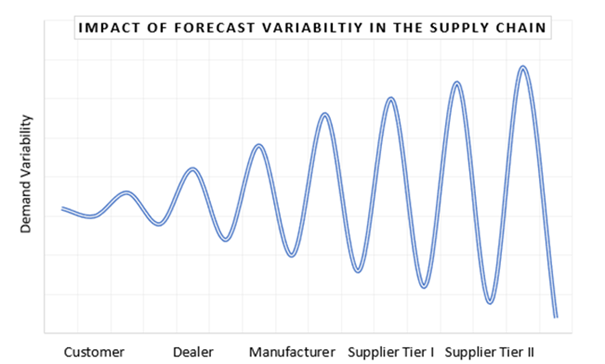

Within the supply chain, the issue of demand variations is at the origin of the Bullwhip effect, a phenomenon theorised as early as 1961. This is because estimating stock is difficult when each link in the chain increases the gap between the forecast and reality. Let’s look at how this “whiplash” or rather series of jolts interferes with the stock and profitability and the ways to avoid it.

Bullwhip effect: what is it?

Bullwhip effect: definition

The Bullwhip effect was theorised by Jay Wright Forrester, the founder of system dynamics. In French, this effect is more akin to the accordion effect or the traffic jam effect, which is also called “amplification of demand variability (AVD)”.

Metaphorically, the bullwhip effect can be likened to the image of a cowboy lassoing the ground: each rope swing corresponds to an event in the supply chain. A small jolt from the cowboy can result in a violent whip at the end of the chain. More concretely, the various stakeholders cannot anticipate sufficiently: a slight variation can create increasingly significant stock increases as you move up the chain. So, the further away the perception of demand is from the final consumer, the less accurate it is.

Bullwhip effect: example

Context: A store has 150 units of product X in stock, replenished every week. Of these, 100 units are sufficient to cover the weekly demand, while the remaining 50 units represent the safety stock of product X. During a week S, demand is higher than usual: 150 units of product X are sold. To meet this demand, the store draws on its safety stock. The bullwhip effect is then triggered:

- The company decided to increase the number of units ordered from the supplier. The store receives 200 X products: 50 to replenish the safety stock and 150 to cover the increased demand.

- So, the supplier receives an order for 200 X products, although he usually delivers only 150. He, therefore, draws on his safety stock to meet the company’s demand. But it doesn’t stop there: he also must replenish his stock according to the increase in demand. The supplier, therefore, increases the number of units ordered from the manufacturer: he orders 250 products, 50 to replenish his safety stock and 200 to cover the company’s demand.

- The manufacturer draws on its safety stock to meet the supplier’s demand. He then readjusts his production: the manufacturer increases the number of units produced to meet the increased demand. He produces 300 products: 250 to meet the supplier’s demand and 50 to replenish his safety stock.

The stock is then too large or useless and increases at each stage of the supply chain because it is not based on the demand of the final customer at the point of sale but on the actor who precedes him. The difference between the actual demand and the assumed demand is thus enormous, which is detrimental to profitability.

Bullwhip effect supply chain causes and consequences

The causes of the bullwhip effect

The initial causes of this phenomenon are multiple, hence the difficulty of avoiding it without the right tools. But they all stem from a lack of anticipation, which takes several forms. It can be:

- Lack of a long-term strategy for supply chain management

- A lack of IT tools capable of promoting collaboration between each link and the monitoring of information

- Too much emphasis on grouped purchases based on economies of scale to benefit from discounts, which are not commercially relevant at the end of the chain

- The simple fear of lack, i.e., the creation of a demand that does not exist factually, leads to over-ordering

- Price variations, such as in this period of crisis when raw materials and energy are rising, and the fear of shortages is generating excessive order quantities

Consequences of the bullwhip effect: an imbalance throughout the chain

Market uncertainty is an issue of commercial stress, even for very small companies. But it is not so much variability that causes the bullwhip effect as a lack of visibility of companies’ real stock requirements. The consequences are then serious financially, with an investment higher than demand and all the associated costs such as storage and logistics costs.

Similarly, paradoxically, such a mechanism can led to stock-outs on certain products, again due to a lack of anticipation. The explanation is simple: faced with an overstock created by the bullwhip effect, the first decision is to stop ordering, but demand can come back like a boomerang.

Finally, the risk is that the manufacturer produces too much in relation to demand and will have to eliminate the overstock by lowering its prices without any certainty. And nobody wins.

All of this also leads to a deterioration in relations between partners. This can be detrimental to collaboration and supplier risk management in a world of commercial and regulatory tension.

Not to mention that the Bullwhip effect also has a high ecological cost in terms of CO2 and that it also contributes to a waste of products, whether manufactured or perishable. In the latter case, the effects are even more significant, as stocks cannot be sold within a certain period.

Bullwhip effect: how to avoid it?

- Establish relevant management rules: limit the purchase of batches; it is better to order only the needed goods and integrate variability and seasonality into safety stocks.

- Give full scope to communication and collaboration among all the links in the supply chain to reduce or even eliminate the uncertainties at the heart of the Bullwhip effect. A good example is sharing upstream and downstream forecasting with key suppliers/customers.

- In the same way, it is essential to forecast sales according to the market and ask the employees who have the information on the ground.

Sales and Operations Planning software is an effective tool to avoid the whiplash effect

Of course, all these solutions cannot occur without the contribution of tools designed for this purpose. Sales and Operations Planning software helps to avoid the Bullwhip effect by providing relevant functionalities that act directly on the organisation:

- Sales forecasting: for reliability, visibility, and reconciliation of information

- Anticipation of the stock in both the medium and long term

- Real-time data update

- Collaboration for all links in the supply chain

Sales and Operations Planning software is essential for reducing overstated security and pooling information. In this way, you can free up free cash flow and financial agility in general.

Colibri is a complete software solution for supply chain management for all business needs:

- Demand Planning

- Supply Planning

- Strategic planning

With Colibri, you finally have visibility on the braking and acceleration of the supply chain to avoid the Bullwhip effect / AVD and all its negative consequences. You improve communication with your partners, making the supplier relationship more responsible and healthier. Would you like to know more? Contact us for more information!